Based in the Republic of Marshall Islands, TRENDSMACRO was founded in 2020. It is owned and operated by the Ascana Group Ltd.

TRENDSMACRO is an excellent choice for individuals starting in the world of investment or those looking to take the next step in their trading journey by scaling up to a more sophisticated account type or a better leverage offer. The broker has different asset classes on offer, including contracts for difference (CFDs) in various sectors, including foreign exchange, stocks, indices, metals and many more.

There are several account types available, including one at the lower end for those with a smaller deposit (Bronze) and high-end accounts all the way up to Platinum for major league investors. As a CFD broker, leverage is available at this broker – although again, it depends on the exact account type chosen as to exactly how much leverage is offered.

There are plenty of reasons to choose TRENDSMACRO, but one of the main ones is the broker’s heavy focus on its investment in technology. On its site, the broker describes technology as its “backbone” – and with a suite of sophisticated platforms based around MetaTrader 4 on offer, it’s easy to see why. In terms of downsides, unfortunately, the education output on offer at this broker is limited – although it’s also the case that the customer support options are plentiful and operate around the clock during the week.

Features

When it comes to special features for traders to engage with, TRENDSMACRO includes:

- No commissions levied on any financial products

- Competitive spreads, at least for some of the higher tier accounts

- 50 foreign exchange currency pairs available to trade

- More than 40 contracts for difference on offer

- Support available during the foreign exchange trading week

- A ‘no requotes’ policy in place to protect traders

Account Types

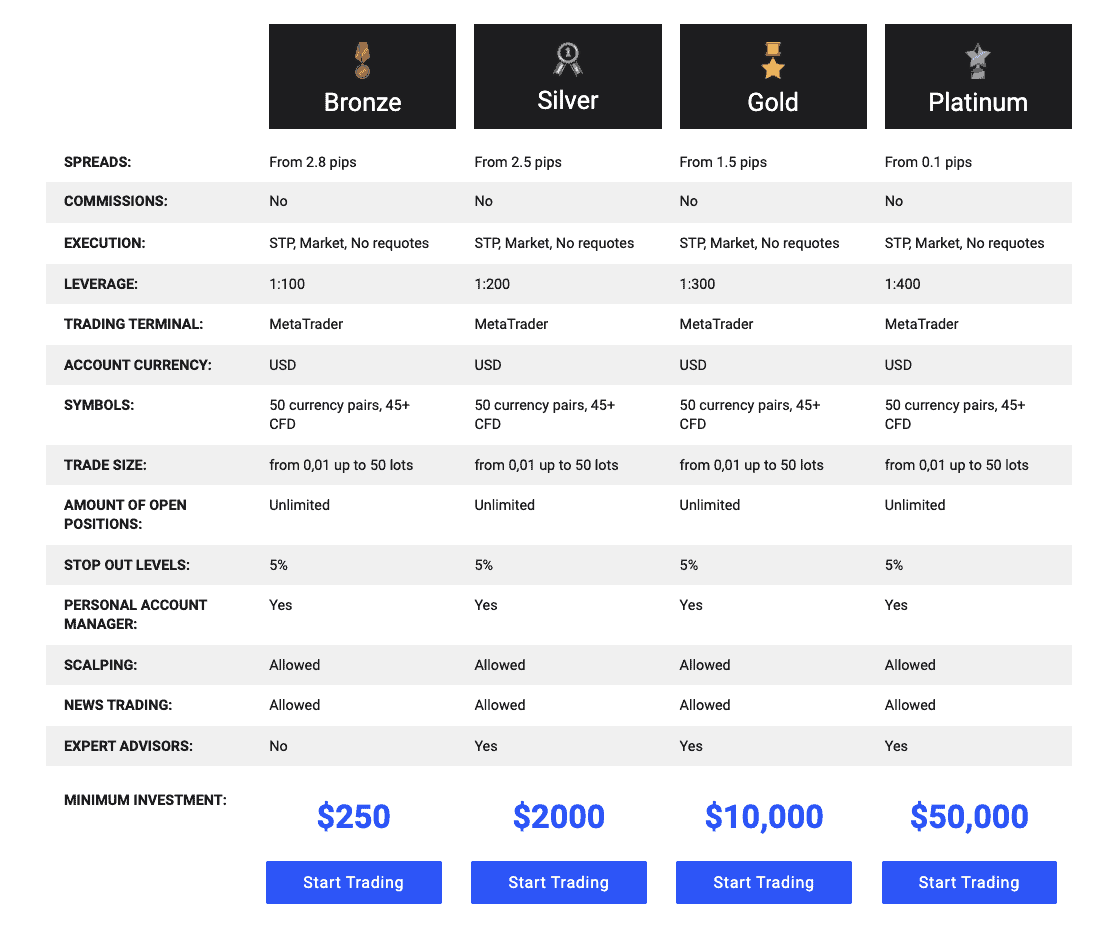

When traders are considering a broker, one of the first things they look for tends to be the diversity of account types on offer. The positive news for traders considering using TRENDSMACRO is that this broker is very focused on providing the maximum variety of choice regarding account types.

The accounts on offer at this broker are diverse, yet they all have some similarities. All are rooted in the world’s reserve currency, the US dollar. It’s also the case that some trading strategies, such as scalping, which at other brokers are banned for one reason or another, are allowed at TRENDSMACRO.

But there are also significant differences between the four different types of account available. For this reason, traders should spend some time looking over the differences and picking the one that makes the most sense for their requirements. The main way in which the accounts differ is in how much they will cost the trader. The accounts all charge on the basis of ‘spread’ fees. While this may seem complex to the newbie trader, it’s quite simple. The spread is just the mathematically calculated difference between the amount you pay for an instrument and the amount you make when you close the position; the fee charged is calculated based on a pre-agreed percentage.

Those who open a Bronze account at TRENDSMACRO are likely to find they are charged relatively high fees on their spreads. These kick-off at 2.8 pips (Bronze), a far cry from the introductory rate of 0.1 pips offered for Platinum account holders. Those who aren’t willing to opt for either of these two extremes might want to consider a Silver account with minimum spread fees just under the Bronze account’s offer at 2.5 pips. Another choice might be the Gold account, which offers traders a base level of 1.5 pips.

Another difference lies in the amount of leverage the broker is willing to extend to the trader. TRENDSMACRO, like so many modern brokers, offers financial instruments that are derivative in nature, meaning that ownership of the actual asset is never conferred. It also means that traders can make the most of what is, in practice, credit: on a leverage-based or margin-based broker platform, the trader can amplify the size of their stake (and, consequently, the size of their win or loss).

A final key difference between the account types lies in the minimum deposit that the trader will need to put down to get started. Bronze account holders will only be able to trade if they offer up $250 as a minimum deposit. Silver account holders will need to put down several times this amount at $2,000. Significant capital is required to open up one of the two higher-tier accounts: Gold account holders have to put down $10,000, while Platinum account holders need to add $50,000 to their accounts before they can proceed. These might be prohibitively high for some traders, and careful research of the market might reveal more cost-effective broker alternatives offering accounts with similarly sophisticated trading conditions.

No matter which account is selected, traders at TRENDSMACRO do not have the option to trade on a commission basis. Instead, it’s all arranged around spread fees as outlined above. That is unlikely to affect many traders, but those with this unusual strategy might want to consider looking elsewhere.

Platforms

Traders who have been in the sector for a while will no doubt recognise MetaTrader 4. It is one of the leading trading platforms available, and it’s a positive sign that TRENDSMACRO offers it to its clients in web-based and mobile formats. Even those at the very start of their trading journey will probably have heard of MetaTrader 4.

It offers traders many benefits, and there’s an obvious reason why it’s been chosen by a technology-focused broker such as TRENDSMACRO; it provides the capacity for multiple orders to be placed at once. For example, it has a robo-trading or Expert Advisor function, too – although this is only available to holders of particular account types. MetaTrader 4 also provides several analysis tools for both fundamental and technical views of the markets.

However, it’s disappointing to see that TRENDSMACRO does not offer traders the opportunity to use MetaTrader 5. That is the latest version of the MetaTrader system and is, in many ways, a more sophisticated alternative. It has some additional features traders might find of value, such as the capacity for hedging and a higher degree of customisability. Those traders who might consider these to be essential features are advised to look elsewhere for their platform needs.

But the version of MetaTrader 4 on offer at TRENDSMACRO is, at least, cross-platform in nature. Traders can use it on the go, thanks to the broker’s compatibility with the MetaTrader 4 mobile application. They can also use a version designed specifically for use on the web rather than having to download software.

Support

Providing plenty of choices is clearly a key priority for those behind TRENDSMACRO. Just as the broker has several account types to pick from, it’s also possible to get in touch with TRENDSMACRO in different ways.

The simplest way to get in touch is to use the self-service form on the broker’s website. That will send the request off via email. It’s also possible to send an email directly to [email protected].

There’s also a telephone option for those who wish to speak to one of the broker’s representatives. This number is based in the UK and is +441887593306.

Those who wish to post a letter to the broker can address it to Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands, MH 96960. This method may incur delays, however, so a phone call or email is advised.

TRENDSMACRO traders need to note that there is no clear information about how long it will take for requests to be answered. However, the broker does note that disputes will be processed within 48 hours.

Traders who have experienced other brokers might notice that some advanced features aren’t available at this broker – such as a live chat function. Having one would significantly enhance the customer service experience and offer traders a more streamlined and efficient response timeframe. On the whole, however, it does appear that TRENDSMACRO provides a decent customer support service.

Trading Instruments

Once a customer has opened an account with TRENDSMACRO, they can then go on to trade many different instruments.

The first group of instruments that are likely to interest traders at this broker are foreign exchange pairs. There are around 50 available to trade on the platform, so there is an extensive choice beyond simply the usual US dollar-dominated major pairs.

Moving on from forex, traders can also – if they wish – choose to trade indices. Lots of the world’s most well-known stock exchanges are represented at TRENDSMACRO, including the Dow Jones in the US and the FTSE in the UK. Stock exchanges from further afield, such as the JSE and the DAX, are also represented. Like most or all of its asset classes, stock exchange trading at this broker is traded on a derivative basis using contracts for difference.

When it comes to metals, one precious version, in particular, can be traded at this broker – gold. Other commodity trading options, including some natural energy options like gas and oil, are available. In terms of shares, the broker is there to offer stakes in various international instruments – both as single stocks and stock indices.

Several of this broker’s asset class options are also available to trade as futures. It applies to commodities, indices and shares. Futures trading is helpful because it allows the trader to ‘lock in’ a certain price now and then benefit from it later.

Deposits/Withdrawals

Making a deposit at this broker is an easy process. There are a number of payment methods that a user can choose in this regard: they can, for example, make a card-based deposit using MasterCard or Visa. Alternatively, they can perform a wire transfer and send funds directly to a bank account. Unusually, TRENDSMACRO asks traders who wish to do that to ask the support team for the relevant bank details – a step that may add delays.

It’s important to note that some additional requirements are placed on traders who are making deposits at this broker. These are outlined on the deposit page and are essential reading so that there is no confusion further down the line. It’s essential, for example, that certain parts of a bank card – such as the CVV code – are left covered up when sending an image of it to the broker. It’s also vital that traders only make payments using methods associated with their own name – otherwise, there could be further delays.

In terms of withdrawals, the whole process is automated to enhance the efficiency of the experience for the trader. The trader first has to log in to their area on the TRENDSMACRO website before clicking on the relevant button. From there, they can specify the amount that they wish to take out, so there is no requirement to withdrawal an account’s entire balance in one go.

As is the case with deposits, however, there are some complex requirements in place. Legislation designed to combat money laundering means that any refunds given to individuals have to be routed back to the same source from which they were sent. Also, it is sometimes the case that a representative of TRENDSMACRO will call you on the phone to check who you are and that your request is legitimate. While this may be an inconvenience, it does at least offer the trader some reassurance that there are measures in place to reduce the risk of fraud.

Overall, it takes around three working days for a request to be pushed through. In some cases, however, it may be as fast as two days. Those who require a faster turnaround are advised to check with the broker to see if the process can be expedited.

Conclusion

Overall, TRENDSMACRO has a lot to offer both novices and experienced foreign exchange traders. The broker has a variety of asset classes on its books, and one of its particular strengths is the range of choice it offers when it comes to account types.

Platform choice at this broker is good, although it would benefit from adding other options such as MetaTrader 5 to its list of available trading platforms. Rather than disperse tips and learning throughout the site, the broker’s education section could also be expanded to be a dedicated part of the site. Some more clarity around the way the broker’s customer support services operate would also be helpful.

Making a deposit is easy, and there are several payment methods for traders to pick from – and the same goes for withdrawals, too.

One final point to note is that this broker doesn’t carry any prominent details about any regulators that it may be overseen by. Some traders could interpret that as a red flag, as it’s usual for brokers to display this sort of information very prominently. However, the broker does send some other signals that suggest it is a legitimate option, including a support centre with telephone and postal contact details as well as some policies on topics like risk warnings.

The individual trader needs to take all of this information on board before signing up and should conduct further research to make an informed decision based on what they find.