Libertex is a brand for the brokerage division and trading platform of Indication Investments Ltd, a member of the Forex Club Group. Based in Moscow, the Russian Federation, Forex Club Group began operations in 1997. Libertex has been providing clients with brokerage services in currencies, stocks, indexes, oil and natural gas, gold and commodities.

Libertex has expanded to service over 2.2 million clients trading from 27 nations around the world. The company employs over 700 people working in Cyprus, the Russian Federation and Belarus. Additionally, the company has a unit registered in St. Vincent and the Grenadines. Libertex has been recognized by winning 30 international awards, including an award for Best Trading Application in the European Union in 2016 by Global Banking and Finance Review and an award by FinEXPO for the Best Trading Platform.

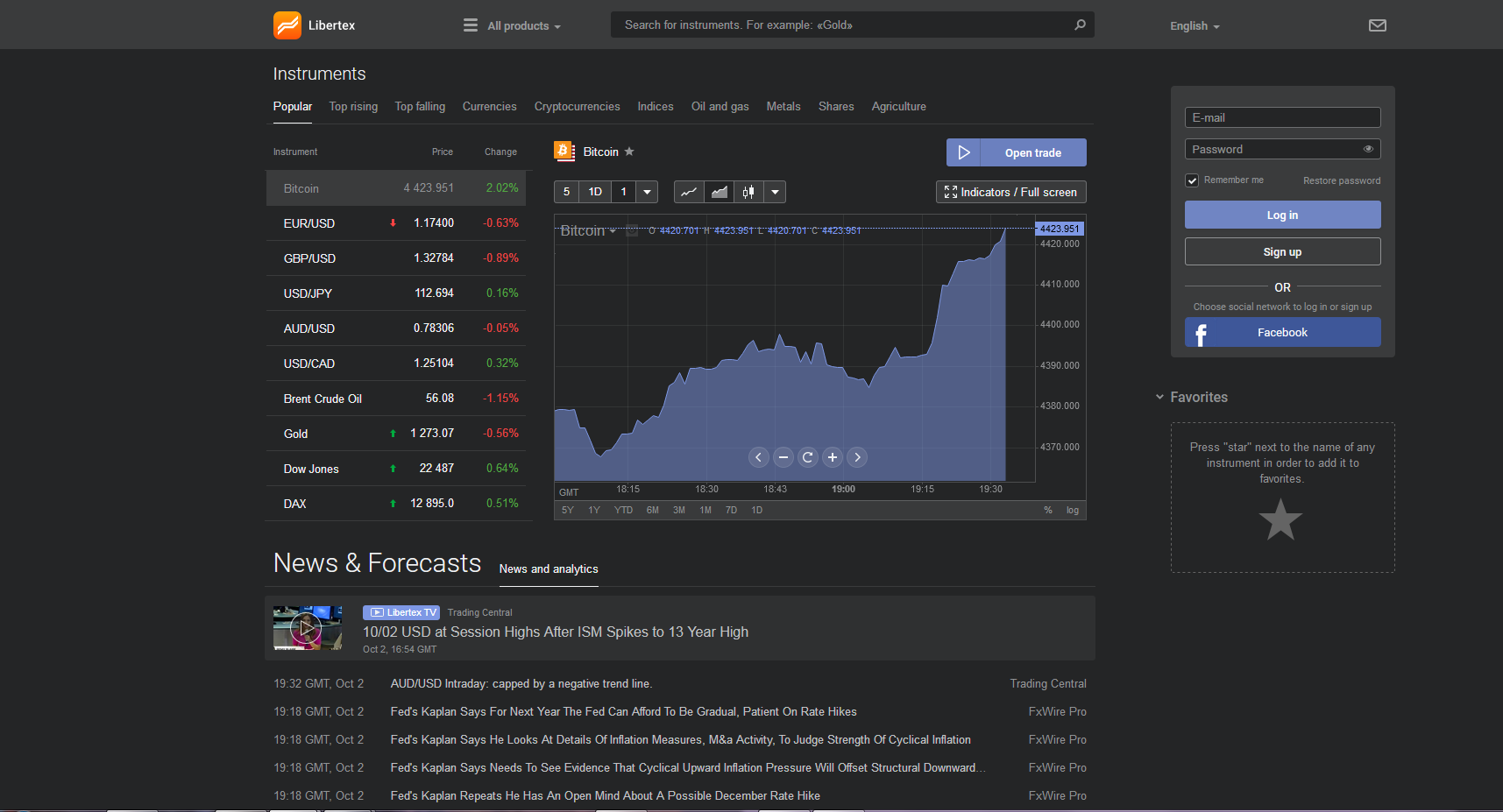

A screenshot of the Libertex home page from their official website can be seen below. The website is located at www.libertex.com:

Please note that at this time, Libertex does not accept U.S. clients. If you live in the United States, you will want to select another broker.

Features

Libertex features 150 tradable assets, offering customers trading in 44 major, minor and exotic currency pairs; 17 of the largest capitalized stock indexes; three types of crude oil, as well as heating oil and natural gas; cryptocurrencies including Bitcoin, BitcoinCash and Litecoin; metals that include gold, platinum, palladium, silver and copper; an extensive list of premium stocks such as Apple Inc., IBM, eBay and Google; commodities, including soybeans, wheat, sugar, coffee, cocoa and corn.

Two critical issues that traders should consider about this broker is one, that the company charges commissions on each transaction, and two, instead of a set leverage figure of for example 200:1, the company instead uses a “multiplier”, which varies considerably from asset to asset. For example, in forex the highest multiplier is for EUR/USD at 500, while the maximum multiplier for USD/RUB is only 10.

Commissions are based on the monetary amount of each trade, for example, for a trade in EUR/USD, Libertex adds a charge of 0.011% on the dollar amount of the transaction. Each tradable asset has different percentage charges. The EUR/USD rate makes up the lowest rate on major currency pairs, with USD/RUB, the highest at 0.41%, followed by EUR/RUB at 0.386%.

All other instruments and tradable assets have different percentage charges. The highest commission charges are for cryptocurrencies, with a 1.02% commission on Litecoin, 1% on BitcoinCash and 0.91% commission on Bitcoin.

Accounts

Libertex makes choosing an account a simple matter: the broker only has one type of funded account and a demo account, which both feature the company’s proprietary dealing platform. Nevertheless, the company includes an impressive news feed powered by FxWire Pro and Trading Central, as well as a Libertex TV channel.

Transactions

According to the company’s website, opening a Libertex account can be done through credit or debit cards, wire transfers or SEPA transfers. Other deposit methods are accepted at the discretion of Libertex, although the company does not guarantee that all transfer methods are available in the client’s country of origin.

As in most online brokerages, proper identification is requested for opening a live account, with the initial deposit and subsequent deposits credited to the account within one day of the funds being cleared in Libertex’s bank account.

To withdraw funds from a Libertex account, a request must be submitted before 1:00PM CET, with the appropriate transfer instructions to the account where the funds originated. The client’s identity is then verified using the valid access codes generated by the withdrawal request. Customers are responsible for any third party charges on withdrawals.

Platform

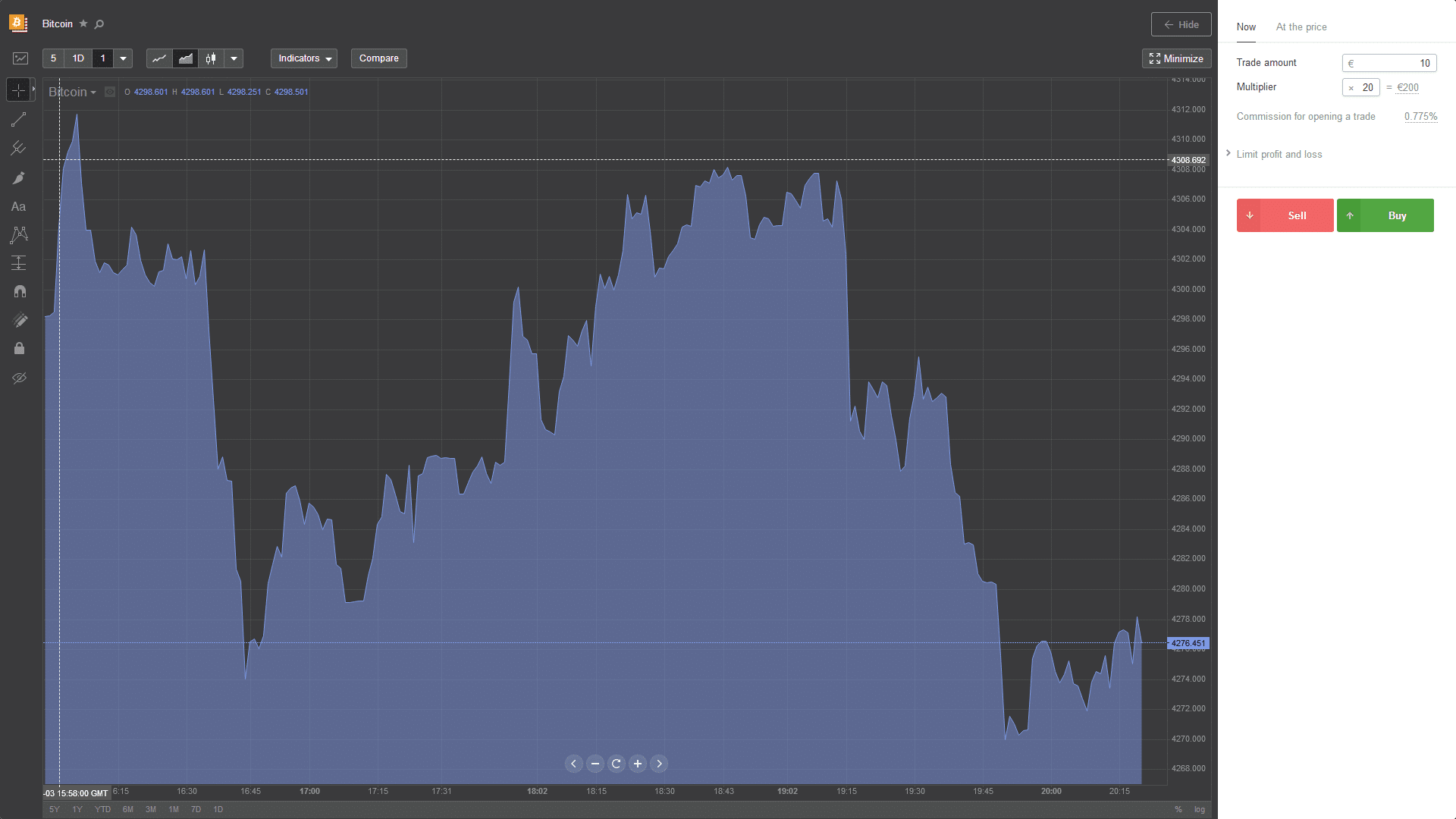

Libertex uses its own proprietary web-based trading platform, which is extremely user-friendly. The platform lacks variables such as margin, leverage and dealer spreads. Once active, the trader simply picks an asset, selects the amount of capital to commit to the trade and then chooses whether to buy or sell.

The Libertex platform has a complete technical analysis component. The technical analysis features offered on the platform are divided into Trend, Volatility and Oscillators. In addition, the platform includes the ability to adjust the time frame on charts from one minute to one month, as well as a section on fundamental analysis.

The Libertex trading platform can be seen in the screenshot below:

Support and Information

Libertex customer support consists of a live chat button on its website. This reviewer could not locate a customer support email address, telephone number or web support form. Educational resources for novice traders also seem non-existent.

Safety

Libertex’s parent company, Indication Investments Limited, has its primary office is in Limassol, Cyprus. The company operates as a Cyprus Investment Firm or CIF and is authorized and regulated under the license number 164/12 by the Cyprus Securities and Exchange Commission or CySEC. Under Cyprus’ Companies Law, Libertex’s registration number is HE 251168, with its registered office situated at 134 Agia Fylaxeos & Amisou, Anissa Court, 4th Floor, 3087, Limassol, Cyprus.

Libertex adheres to local and European regulations due to its oversight by CySEC, which includes the MiFID of Markets in Financial Instruments European Directive. In addition, the company must comply with the European Union’s Law 144(1)/2007 or the Investment Services and Activities and Regulated Markets Law of 2007.

Overall

Libertex gives the general impression of an efficient online broker without many bells and whistles. The company is regulated by CySEC, thereby helping ensure the safety and segregation of customer funds, which is a big plus. In addition, the company’s award winning dealing platform, which includes an excellent news feed, is easy to use and ideal for novice traders to use. The company also offers its clients limited risk exposure.

Disadvantages for this broker include its lack of support for industry standard MetaTrader4 trading platform, while its variable commission schedule and the use of an equally variable “multiplier” on all tradable assets could be seen as pluses or minuses. Also, the virtually non-existent customer service department and equally absent educational resources work against this broker, especially for novice traders that might need the extra help.

See all currency broker reviews