There are plenty of good reasons to justify choosing FXCentrum as your forex/CFD broker. The whole platform is designed to be easy to use, but at the same time there are professional-grade features to put you in the best possible position when entering the markets. As a relatively new entrant to the broker sector FXCentrum offers a range of innovative features, and getting a better understanding of how they work can help you establish if the broker is the best fit for your style of trading?

Online broker FXCentrum, also referred to as FXC, was founded in 2019. In a relatively short period of time, the firm has developed a global client base of +50,000 clients who have given the broker an impressive Trustpilot ranking of 4.8. Part of the reason for the success of FXC is the way the firm has taken advantage of being a next-generation broker. The online platform is easy to navigate, accounts can be set up in a matter of minutes, and there are a large range of funding options including crypto. Should you need assistance, the customer service team offers support in 50 different languages, so you can get the help you need to trade forex, stocks, indices, and commodities.

FXCentrum is authorised and licensed by the Financial Services Authority (FSA) in Seychelles where it holds the license number SD055. FXCentrum is the trading name of the parent company WTG Ltd which has its headquarters at Office 5B, HIS building, Providence Mahé, Seychelles. WTG’s registered address is House of Francis, Room 302, Ile Du Port, Mahe, Seychelles.

FXCentrum’s Trading Instrument Offer

FXC provides clients access to a wide range of different areas of the financial markets. If you’re a specialist forex trader, then you can choose to trade from 42 currency pairs including those in major, minor, and exotic markets. There are 22 commodity markets to trade which is above average for the broker sector and will make FXC a good fit for those wanting to develop strategies based around price moves in raw materials. Whether you’re looking to trade oil and gas, or cotton, cocoa, and aluminium, the range of commodity markets on offer is a standout feature of the platform.

The diverse range of instruments on offer extends to 35 stock indices and 134 individual stocks. Which when all added up means that FXC clients can choose to focus on one instrument or adopt a macro view and gain broad exposure to different areas of the financial markets.

- Commodity markets: 22

- Currency markets: 42

- Indices: 35

- Stocks: 134

The absence of crypto markets and non-US stocks might be a negative point for some traders, but for most there will be a sufficient range of markets to choose from.

When you go to book your first trade, you’ll notice that pricing terms are competitive, and the schedule of fees is laid out in a transparent manner. Brokers who are confident in their position in the market tend to make it easy for clients to monitor fees – and that is certainly the case with FXC. There are zero commissions on trades, and spreads start as low as 0.3 pips. The firm uses variable spreads, which means the difference between the buy and sell price will vary according to underlying market conditions. Leverage terms are also flexible, and you can take your margin rate up to 1: 1,000.

Hedging is permitted at FXC, there are no account management fees, and cash deposits are free of charge. Your first cash withdrawal of any calendar month is also free, with any subsequent withdrawals before month-end coming with a $10 fee.

Scalping is not permitted, with the broker’s definition of that type of trading being entering into and closing out positions in less than three minutes.

FX Centrum Account Types

Opening a Demo account takes seconds to do and offers a way to test the FXC platform, or new strategies in a risk-free environment. The process of opening a live cash account takes not much longer thanks to the broker having set up a streamlined and user-friendly onboarding process.

The principle of ease-of-use also extends to payment options. You can fund your account via a large number of providers, including Visa, Mastercard, Astropay, Help2Pay, OnlineNaira, MoonPay, Perfect Money, Korapay, Ozow, NetBanking, UPI and Pix. It is also possible to fund your account using Bitcoin and Tether.

Many of those payment agents will complete the transfer into your new FXC account instantly. Once that is done you can access a wide range of different financial markets by inputting your own trades or allocating capital to other traders using the FXC Copytrading service. Trades booked following either approach feed into the same account, which ensures you can track your overall exposure to the markets from one report. The minimum account opening balance is $10 or €10, base currency options being USD or EUR, and Islamic swap-free accounts are available. There is no official minimum balance requirement for the FXC Copytrading service, but FXC does advise that $250 would be a realistic amount to commit if you want trades booked to your account to accurately reflect those of your chosen Money Manager.

If you do follow one of the lead traders, referred to as Money Managers, your account will copy their trades until you agree to discontinue the relationship, something that can be done at any time. During the time period when you are following a Money Manager you will have the option to adjust the amount of capital allocated to them and have messages sent to you when significant events such as traders occur. Both of these features are useful in terms of risk-management and help you balance out the advantages of allocating the workload to someone else, and the need to keep on top of any third-party trader.

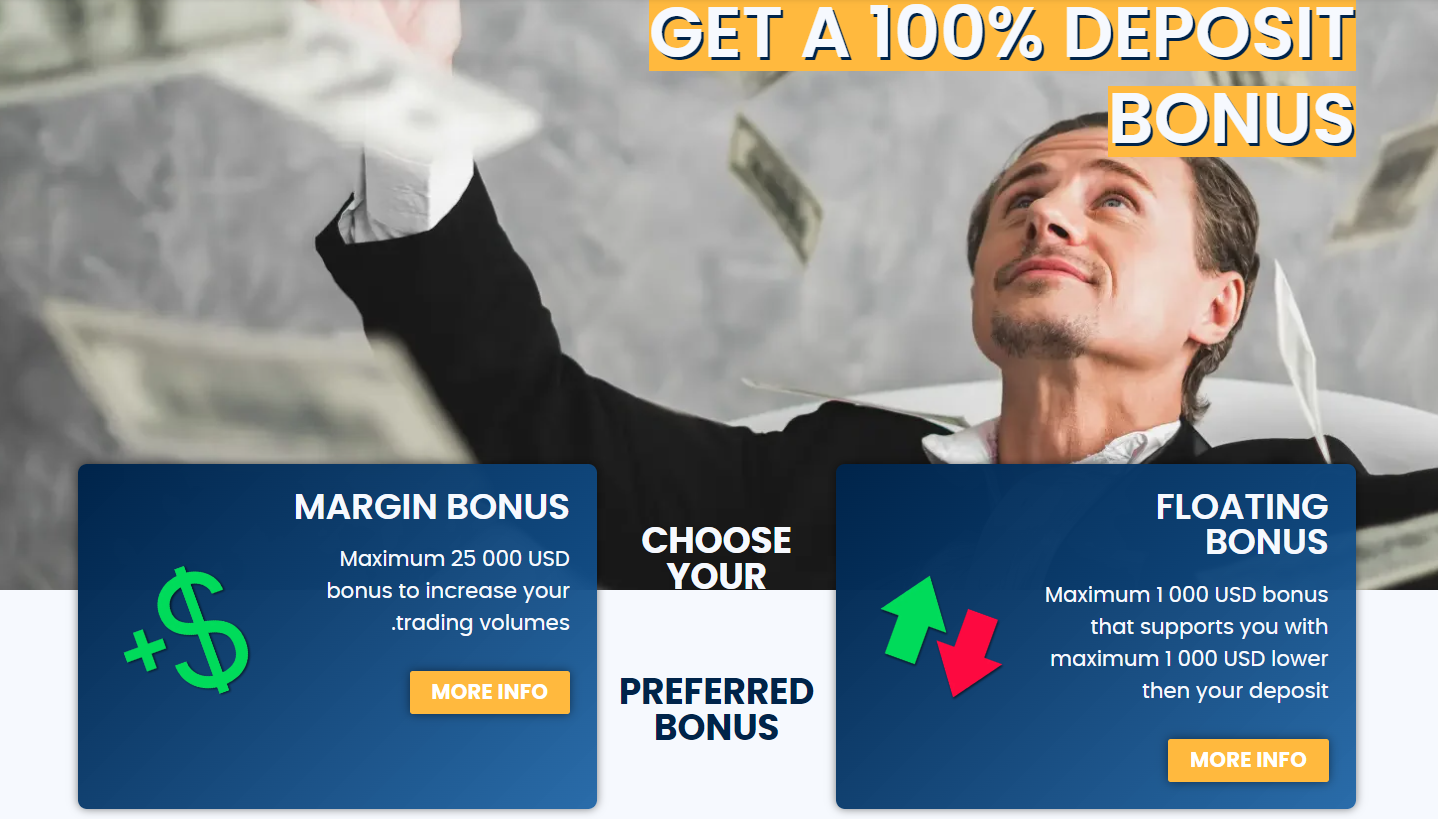

There is only one account on offer – and the T&Cs are competitive enough to ensure that prospective clients don’t lose out from being able to choose from two or three account options. Something which might require more thought are the range of promotional features on offer at FXC. These change over time, and eligibility to take part will depend on your country of domicile, but they are worth considering as they offer additional support if you are trading for the first time.

A promotion frequently offered to new clients is a 100% cash bonus on initial cash deposits. This bonus can be applied to your account in two different ways. The first ‘Margin Bonus’ approach matches your deposit of up to $25,000 by 100% and allows you to use the bonus cash as collateral and book trades in a larger size than would otherwise be possible. The second ‘Floating Bonus’ applies on deposits of up to $1,000 and acts as a safeguard against trading losses. If you have loss-making trades, these will use up the cash bonus first before reducing the balance of cash which you placed into your account. There are also monthly trading competitions where the FXC trader who posts the best return receives a cash prize.

Not all brokers offer promotions such as these and FSC’s ability to do so stems from their choice to be regulated by the Financial Services Authority (FSA) of Seychelles. That regulator is an established operator and adopts a familiar approach towards client care, for example requiring FXC to gain sufficient knowledge of each client’s personal situation by asking a range of questions during the onboarding process. That KYC (Know Your Client) information gathering is part of a larger program of client care protocols some of which have been put in place voluntarily by the broker and includes:

- Guarantee of Processing – The broker guarantees that your deposit and withdrawal will be processed.

- Guarantee of No Commissions – The firm is committed to zero commissions on all trading carried out on the FXCentrum platform.

- Guarantee of Support – A guarantee of extensive support for clients and an excellent trading experience.

- Guarantee of Protection – Negative balance protection (NBP) is in place which ensures you can’t lose more money than you place into your account.

- Guarantee of Retention – A commitment to provide a personal account manager to those clients which meet the necessary deposit requirements.

Clients of some countries, including the US, will find that for regulatory reasons they are not permitted to open an account. Those from other regions, such as the EU, may find they are required to provide additional information to ensure FXC comply with the terms of their license.

FXCentrum Trading Platforms

The in-house designed FXC Traders trading dashboard which is the core platform of FXC has an appealing aesthetic and intuitive functionality. Its easy to navigate to whichever market you want to, and during our testing we found that trade execution was performed rapidly and reliably. There are also a range of impressive additional features which can help you get into the best position to enter the market.

Trade monitors and price charts are packed full of powerful software tools such as the 21 technical indicators which are designed to spot trading opportunities. The trade execution monitor conveniently provides adjustable stop loss and take profit orders so that you can manage risk. These can also be adjusted post trade if you need to adapt your strategy to changing market conditions. Alternatively, you can use the ‘pending order’ execution option which allows you to take a more patient approach and set levels at which you would ideally like to enter into a trade.

If you’re fine-tuning your strategy before trading, then you might like to use the ‘social feed’ area of the trading dashboard which can be a good source of trading ideas. That function analyses market trends and gives a clear ‘buy’ or ‘sell’ reading on popular markets. And if you want to ensure you are getting the most out of the tools on offer, you can speak with a dedicated account manager, or the customer support team via telephone, Live Chat, social media channels and email.

Running in parallel to the self-trading dashboard is the FXC Copytrading service. Selecting which trader to follow is helped by the Super Stats tool which ranks them by performance and allows potential followers to investigate the trading style of each Money Manager to a granular level. Whichever approach you take, you can be confident that the FXC platforms will get you in the best position to trade.

Conclusion

FXCentrum is a forward-looking broker with an innovative approach. It’s rapid growth and positive user ratings stem from the firm getting the basics right and adding a lot of additional features into the package as well. Traders will form their own view on whether the use of a Tier-2 regulator, the FSA, is right for them, but by operating out of Seychelles the firm is able to take a more flexible approach to promotions and bonus offers. Those incentive packages can be a great support when you start trading, and with the all-round service of the standard that it is, there’s no reason to not try the platform out.