Launched way back in 2007, Forex4You is much more than an online trading industry veteran, which has managed to maintain a healthy reputation over more than a decade now.

The broker is a true innovator and unlike most of its peers, it offers an attractive selection of promotions, coupled with a rather ideal offer of trading platforms. Forex4You also provides access to cryptocurrency-based CFDs, making its overall offer one of the best in the business.

The operation is a truly global one, maintaining offices and employees in several countries world-over.

The best way to paint a brief but accurate picture of the magnitude of the operation is through a handful of numbers.

Up until 2017, the broker registered more than 1.6 million trader accounts, executing close to a billion orders. At any moment, Forex4You has over 600,000 open orders in the markets.

Despite its global scope and its impressive overall standing, the regulatory status of the broker is not particularly impressive.

The corporate entity behind the Forex4You brand is a certain E-Global Trade and Finance Group Inc, based on the British Virgin Islands. Indeed, that jurisdiction is not exactly the most prestigious when it comes to regulation.

The regulatory agency which has given its blessings to the broker, is the FSC of the British Virgin Islands. The license number of the operator is SIBA/L/12/1027.

Given this sort of regulation, it sort of goes without saying that the broker does not allow traders from the US and Japan to access its services. What’s more though, not even traders from the European Economic area can join the broker and trade with it. All that considered, the data mentioned above regarding the number of accounts opened at the broker, is obviously all the more impressive.

The fact that its reputation is “good” does not mean that there are no trader complaints about Forex4You out there either. The usual medley of feedback concerning stop-loss manipulation and some withdrawal issues is present, though the problems do not seem to be systematic and the positive feedback is overwhelming in terms of volume too.

Why would you then – knowing the above – want to join Forex4You?

As already mentioned, the broker has fielded quite an array of unique selling points.

Its promotions, crypto-coverage, copy trading service and managed (PAMM) accounts all fit into this category, but there is a lot more to it draws-wise.

The broker – which is obviously focused on Asia – has picked up several rewards. It offers maximum leverage of 1:1000 coupled with more than decent trading conditions, featuring some rather outstanding spreads in some cases.

Free market analytics are also available and the order execution is good too. Webinars and seminars are offered to beginners and advanced traders alike, together with 24/7 live help.

As far as the safety of trader funds and overall operational transparency is concerned, the broker puts out financial statements which are audited by an independent 3rd party on a yearly basis. Willis Group Holdings Plc is the insurance provider of the broker.

Market Coverage

While it is not industry-best in regards to how many tradable assets it offers, the market coverage of Forex4You is still quite outstanding.

It covers Forex pairs (of which more than 50 are tradable), commodities, indices, stocks and cryptocurrencies. All-in-all, more than 150 assets from these categories can be traded.

Promotions

Its regulatory situation not being a hurdle in this regard, the broker can offer a handful of extremely interesting – and potentially profitable – promotions.

The $30 welcome bonus is just the tip of the iceberg in this regard. In addition to it, traders also receive a 100% bonus on the deposits they make. Given that there is no minimum deposit requirement at the brokerage, that is one way to make sure that people do not deposit pocket change.

The truth is that while this bonus is not limited amount-wise, it really depends on the deposited amount, running from 5% to 100%

Other promotions are the 50% Cash Rebate program, which offers money back on commissions and spreads, and the Trading Hero Contest, which hands out as much as $400 every fortnight, to those who log the best results trading-wise, during the promotional period. Traders are required to register manually for this one.

Trading Platforms

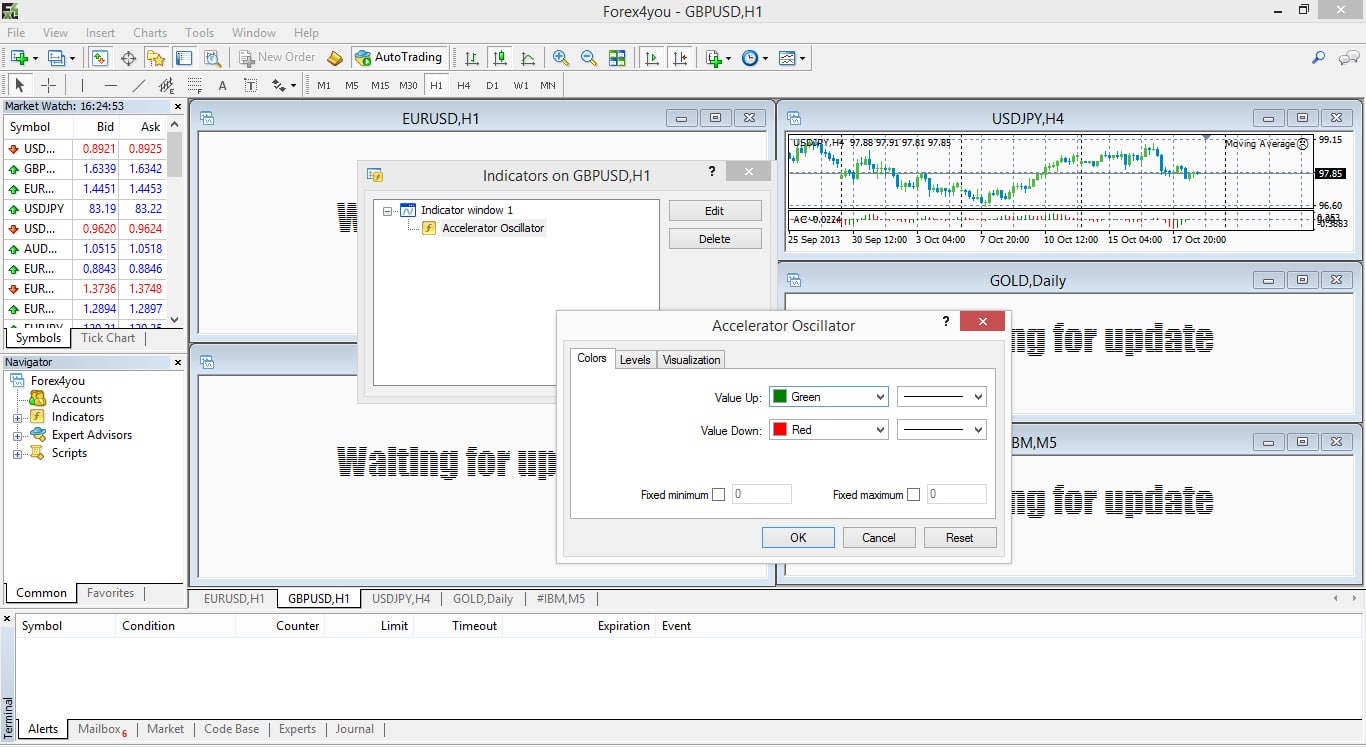

The broker features a rather attractive selection of trading platforms, from its own, proprietary solutions, to MT4.

The proprietary platform selection includes a web trader, as well as a desktop trader and a couple of mobile apps, for Android and iOS.

The web trader – which is the easiest to use – features an attractive user interface and a number of very interesting tools/settings. One such tool is the trading control one, which allows traders to set the slippage they are willing to tolerate. Do not worry though: you are actually allowed to set this to 0 too.

The Web Trader also makes it possible for users to view the liquidity provided by different liquidity providers.

MT4 is the most solid and popular trading platform in the world for a good reason: it is indeed the best of the best when it comes to charting, analysis and actual trading too. It is also fully customizable. Traders can install their own technical indicators, custom scripts and EAs. EA support is one of the best-liked features of the trading platform. EAs always work best with a proper VPS service.

Account Types

In addition to the Demo account it offers, the broker supports no fewer than 5 different real money account types.

The first of these is the Cent Account, which is the cheapest and thus the most accessible. It features fixed spreads from 1.5 pips and maximum leverage of 1:1000.

The Classic Account is quite similar to the Cent one, with the difference that it does not deal in Cents as the base currency unit, and that its fixed spreads start from 2 pips.

The Cent NDD Account is yet another spin on the Cent Account above. It features floating spreads from 0.1 pips and it charges a commission of 10 cents per traded lot.

The Classic NDD Account features floating spreads as well. Its commissions start from $8 per traded lot.

All the above accounts offer access to the promotions already covered above.

The Pro STP Account is an exception in this regard. Its variable spreads start from 0 pips, and the commissions charged are 10 base currency units per lot. The leverage is flexible on this account type too: it goes from 1:10, all the way to 1:200.

The Pro STP Account does not feature promotions.

Deposit/Withdrawal

The deposit/withdrawal methods accepted by the broker fit into two categories: bank cards and electronic payment systems.

Accepted bank cards are VI SA and MasterCard, while the electronic systems category features Neteller, Skrill and Webmoney.

Conclusion

Despite its none-too-impressive regulatory status, Forex4You is a very solid destination for the trading of FX and CFDs. Its reputation is good, its trading conditions are great and its account-type selection is more than satisfactory as well.

The platform selection of the brokerage is great too. In fact, there’s no operational aspect in which the broker cannot at least be described as “good”.

Read all forex broker reviews